Mortgage Affordability Calculator Self Employed

Use our self-employed mortgage calculator to work out how much you might be able to borrow based on the nature of your employment your income and other factors. This is done to adjust your net income downward by the total employment tax that would have been paid by an employer had you not been self-employed.

How To Get A Mortgage When Self Employed Forbes Advisor

Sole trader mortgage affordability For a lender to establish a self-employed borrowers annual income a proven and well-documented history of trading is required.

Mortgage affordability calculator self employed. The calculator will ask you. Most lenders require three years trading history before they will consider the applicants income stable enough to lend on. It provided new temporary guidance to lenders approving self.

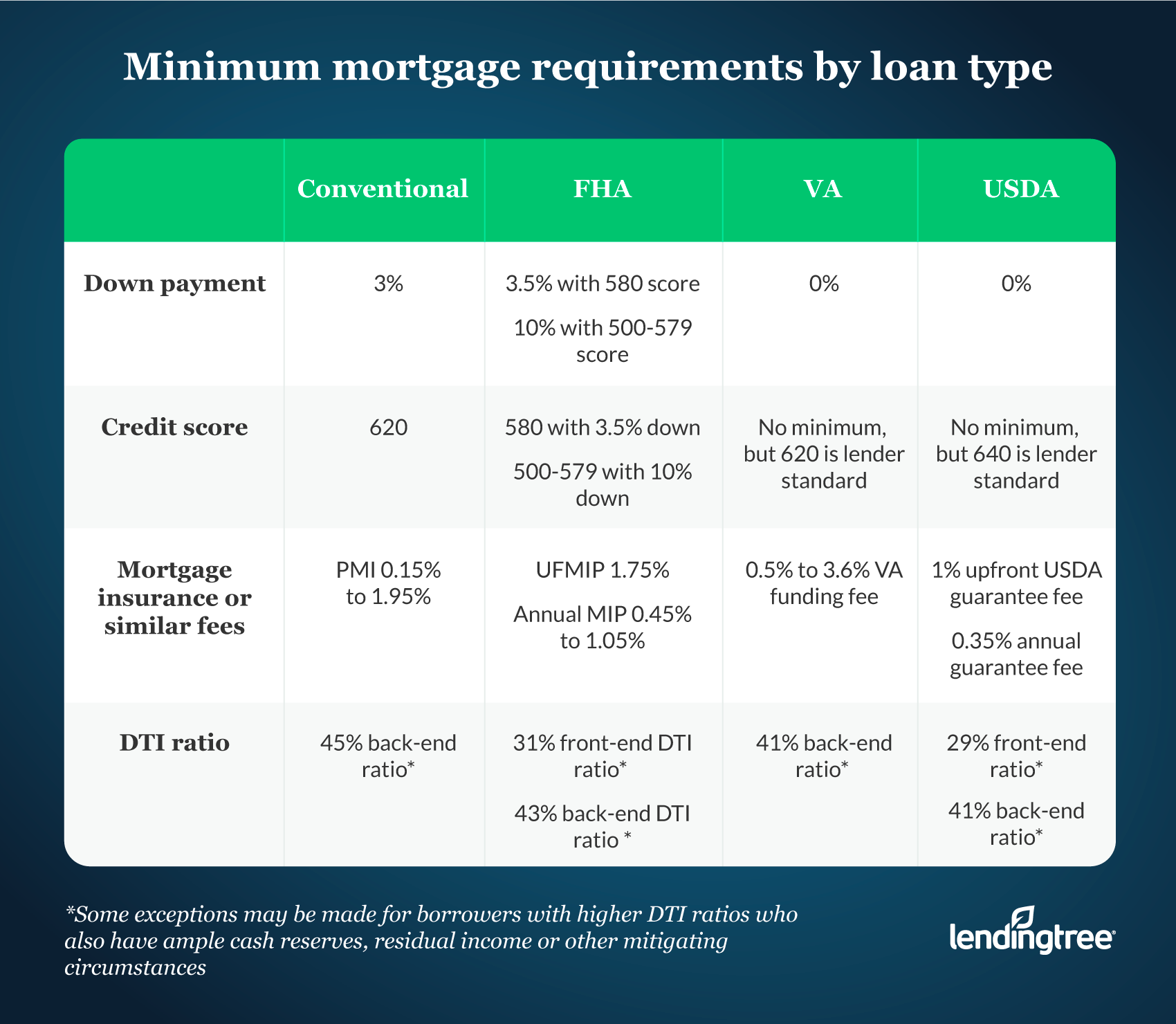

Mortgage lenders typically look for a minimum credit score of 620. And while its possible to qualify for a mortgage as a self-employed borrower with a score that low the likelihood of approval is greater if your score is much higher. If youve filed at least 1 year of business returns and want a lender to help determine what you qualify for and which mortgage will best meet your goals get.

Rising health care costs have caused many large established companies to either outsource or hire contractors while downsizing their core workforce. You simply plug in your income and debt obligations and poof the calculator will spit out an estimate of how much of a loan your mortgage company might extend to you. In less than 3 minutes our handy mortgage calculator will give you a good idea of how.

New FHA rules for self-employed home buyers. If you are self-employed dont fret. You see we dont feel the need for a separate mortgage calculator specifically for the self-employed.

The actual amount you will be able to borrow can vary from lender to lender and will be based on. Being a self employed borrower does present its challenges when qualifying for a mortgage simply from the documentation required and the income calculation rules but with the help of a licensed and experience loan officer youll be in good hands. This is our self-employed mortgage calculator page.

Your income may vary but you will still be eligible for a mortgage based on the previous two years of income youve earned. Bon Accord mortgages is a trading name of Aspire Mortgage Solutions Ltd which is an appointed representative of Mortgage Advice Bureau Limited and Mortgage Advice Bureau Derby Limited which are authorised and regulated by the Financial. And remember even though there might be a limit to the amount you can borrow you can save as much deposit as you like to make up the balance.

Mortgage Calculator for the Self-Employed. Across the United States annual healthcare spending per capita is 9403 - nearly double what is spent in other developed markets. How much you can borrow depends on your means and your income based on rules laid out by the Central Bank of Ireland.

Unlike some other mortgage affordability calculators RBCs mortgage affordability calculator does not take into account your location for property taxes and utility costs. But the lender also looks at something else when reviewing years one and two. For example say year one the business income is 80000 and year two 83000.

Estimating how much of a mortgage you might qualify for is a relatively easy process with online mortgage affordability calculators. How does the calculator work. When you use a self-employed mortgage calculator youll usually be asked to put how much you get paid your pension contribution and the business expenses to work out your affordability and what your repayments are likely to be.

On July 28 2020 the FHA sent out a letter to all lenders that offer its loans. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. A self-employed mortgage calculator uses the information you put in to calculate what your mortgage repayments might be based on your income.

If you have any other questions just get in touch with our advisors who will be happy to help. The only details we require from you is the approximate value of the home you are looking to purchase or remortage along with your annual income to see how much you may be able to borrow. For employees its all relatively straightforward based on salary plus any additional allowances or bonuscommissions.

If your down payment is less than 20 RBCs mortgage affordability calculator also considers your mortgage insurance premiums. Please note that the mortgage amount provided by the calculator is for illustrative purposes only. How Much Mortgage Can You Afford If Youre Self-Employed.

This is for people who own part of a company or are sole traders. If youre looking for a self-employed mortgage a lenders mortgage affordability checks still work broadly the same way although you will have to provide evidence of how your earnings have been raised. Self-Employed Calculator Fill out our quick and easy mortgage calculator below.

Unlike other providers we dont treat the self-employed any differently to people in full time employment. You can use our self employed mortgage calculator to find out how much you can borrow on a mortgage. Therefore if you want to find out how much we might lend to you please feel free to use our standard calulators below.

Your mortgage affordability is up to 387192 including 14892 for CMHC insurance premiums. Mortgages for the Self-Employed Get a great mortgage deal even if you only have 1 years accounts. The income used for qualifying purposes is 80000 83000 163000 then divided by 24 6791 per month.

To be eligible for the self-employed mortgage you must have been operating your self-employed business for at least 2 years. Obtaining a Mortgage As a Self Employed Person Self-employment. Because the affordability of the home you wish to purchase is based on the household income of the applicants who are trying to buy the property you need to ensure you have a steady income.

SELF EMPLOYED MORTGAGE CALCULATOR.

Home Affordability Calculator For Excel

Self Employed Mortgage Loan Calculating Income And Best Home Loan Options

2021 Minimum Mortgage Requirements Lendingtree

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Online Mortgage Calculators Free Personal Finance Calculation Tools

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Home Affordability Calculator To Pre Qualify In 2021 Real Estate Advice Home Buying Real Estate Investing

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

How To Get Pre Approved For A Mortgage

Self Employed Mortgage Loan Calculating Income And Best Home Loan Options

Schedule C Income Mortgagemark Com

Self Employed Mortgage Loan Calculating Income And Best Home Loan Options

Mortgage Pre Approval Calculator

How Much House Can I Afford Forbes Advisor

Mortgage Affordability Calculator Based On New Cmhc 2021 Rules Wowa Ca

Mortgage Calculator How Much Can I Borrow Compare The Market

How Much House Can I Afford Home Affordability Calculator Mortgage Interest Rates Preapproved Mortgage Mortgage Interest

How To Get A Mortgage If You Re Self Employed In 2021 Mortgage Blog

Post a Comment for "Mortgage Affordability Calculator Self Employed"